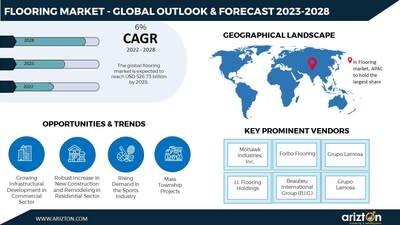

CHICAGO, Feb. 7, 2023 /PRNewswire/ — According to Arizton’s latest research report, the flooring market will grow at a CAGR of 6{47b453017e945efa530f5a0970507fdb946b2530ae0a03634d0aa42ba42c4637} during 2022-2028. Growing partnerships for digital marketing, emerging new technologies in the flooring market, and high demand for luxury vinyl tiles drive market growth. APAC dominated the global flooring market share and was valued at USD 176.15 billion in 2022. Developing countries such as India and China are important construction markets with significant demand and promising growth potential. Due to the benefit of having a large market share for modern building and construction technologies, APAC is expected to lead the global flooring market.

In recent years, vendors in the global flooring market have forged partnerships with digital marketing firms. Digital marketing observes a huge shift toward advertising with more personal, creative, and targeted content and images. In addition, digital marketing provides significant levels of information and resources that consumers can access at any time from different locations. This creates an opportunity for retailers to gather data to develop and restructure marketing strategies for the flooring industry. Moreover, many manufacturers of flooring products prefer digital marketing to increase their reach in the market. The products’ efficiency and quality drive customers toward flooring products. Customers across the globe are seeking flooring products and services through e-commerce sites and proprietary brand websites. With the help of digital marketing, companies provide services and sources on various platforms to increase customer reach in the market. The companies are focusing on tie-ups with digital marketing firms to expand their market presence.

Global Flooring Market Report Scope

|

Report Attributes |

Details |

|

Market Size (2028) |

USD 526.73 Billion |

|

Market Size (2022) |

USD 376.20 Billion |

|

CAGR (2022-2028) |

5.77 {47b453017e945efa530f5a0970507fdb946b2530ae0a03634d0aa42ba42c4637} |

|

Base Year |

2022 |

|

Forecast Year |

2023-2028 |

|

Market Segments |

Product, Application, Distribution Channel, End-User, and Geography |

|

Geographic Analysis |

North America, Europe, APAC, Latin America, and Middle East & Africa |

|

Countries Covered |

The US, Canada, Germany, the UK, Italy, France, Spain, China, Japan, South Korea, India, Australia, Brazil, Mexico, Argentina, South Africa, Saudi Arabia, the UAE, and Turkey |

|

Key Players |

Mohawk Industries, Inc., Forbo Flooring, Beaulieu International Group (B.I.G.), Grupo Lamosa, LL Flooring Holdings, RAK Ceramics, Tarkett, Shaw Industries Group (Berkshire Hathaway), Interface, Victoria, Burke Flooring (Mannington Commercial, Mannington Mills), Gerflor Group, Pamesa Ceramica Compactto, AHF, Kajaria Ceramics, Portobello, Polyflor, Crossville, PORCELANOSA Grupo, SCG Ceramics, Congoleum, Dixie Group, Brumark, Dorsett Industries, Milliken, Oriental Weavers, Axminster Carpets, Brintons Carpets, and Betap |

|

Market Dynamics |

· Growing Infrastructural Development in Commercial Sector · Robust Increase in New Construction and Remodeling in Residential Sector · Rising Demand in the Sports Industry · Mass Township Projects |

|

Page Number |

378 |

|

Customization Request |

If our report does not include the information you are searching for, you may contact us to have a report tailored to your specific business needs https://www.arizton.com/customize-report/3702 |

Click Here to Download the Free Sample Report

Increasing Demand for Luxury Vinyl Tiles Worldwide

Recently, Luxury Vinyl Tiles (LVTs) have emerged as an increasingly popular flooring product. LVTs are polished and better-looking versions of typical vinyl floors. Thus, LVTs are more durable, aesthetically appealing, high quality, and low maintenance flooring products at excellent prices. These tiles are most appealing to customers due to their availability in various colors and style choices, ranging from traditional to modern shapes and forms. In addition, the flexural strength and hardness of LVTs make them durable and resilient in areas with heavy foot traffic. Currently, luxury vinyl tiles are available in wooden look form with a soft underfoot feeling, in a tile and plank form. LVT is mainly preferred for bedrooms, fancy areas, and living rooms of residence for a perfect finish and classy look. Hence, the residential sector is expected to create considerable demand for LVT during the forecast period.

The choice of the right distribution channel has enabled vendors to drive the sales of their flooring products. These flooring products are made available to consumers via several brick-and-mortar retail shops and online websites. B2B supermarkets are large self-service stores that offer a comprehensive range of products for several businesses. Hypermarkets have large retail spaces and act as a combination of supermarkets and department stores. Both these retail formats cater to the requirements of customers for flooring tiles. One can find a comprehensive assortment of products from diverse brands at such stores. These stores have a high footfall and offer ample opportunities for vendors to highlight their flooring products. Supermarkets and hypermarkets are other retail store options for flooring product vendors to sell their products by acquiring a large shelf space. However, vendors can boost their sales through better relations, offers, gifts, and product promotions in small retail shops or departmental stores. In 2020, North America had around 85 supermarkets, ranked among the top 250 supermarkets worldwide, with 85 in the US alone. Europe and APAC had around 87 and 60 supermarkets featured in the top 250 supermarkets worldwide. Therefore, offline distribution channels boost flooring products’ sales in the global market.

Key Company Profiles

-

Burke Flooring (Mannington Commercial, Mannington Mills)

-

Gerflor Group

-

Pamesa Ceramica Compactto

-

AHF

-

Kajaria Ceramics

-

Portobello

-

Polyflor

-

Crossville

-

PORCELANOSA Grupo

-

SCG Ceramics

-

Congoleum

-

Dixie Group

-

Brumark

-

Dorsett Industries

-

Milliken

-

Oriental Weavers

-

Axminster Carpets

-

Brintons Carpets

-

Betap

Market Segmentation

Product

-

Non-Resilient Flooring

-

Resilient Flooring

Application

-

Replacement

-

New Construction

Distribution Channel

End-User

-

Residential

-

Non-Residential

Geography

-

North America

-

Europe

-

APAC

-

Latin America

-

Middle East & Africa

Click Here to Download the Free Sample Report

Check Out Some of the Top Selling Research Related Reports:

Floor Sealer and Finisher Market – Global Outlook & Forecast 2021-2026: The global floor sealer and finisher market size was valued at USD 2.2 billion in 2020, growing at a cumulative average growth rate (CAGR) of 7.58{47b453017e945efa530f5a0970507fdb946b2530ae0a03634d0aa42ba42c4637} during the forecast period. Renovation and remodeling are the significant factors driving the market’s growth globally.

Raised Access Flooring Market – Global Outlook and Forecast 2020-2025: The global raised access flooring market size will cross USD 900 million by 2025, growing at a CAGR of over 2{47b453017e945efa530f5a0970507fdb946b2530ae0a03634d0aa42ba42c4637} from 2020-2025. The usage of raised access flooring technology is increasing due to the growth in the construction market. The optimal use of floor space is one of the primary reasons for the growth of this technology. The increase in building permits for private residential houses and the growth of commercial construction are key factors influencing the market significantly.

Carpet Flooring Market – Global Outlook & Forecast 2023-2028: The global carpet flooring market was valued at USD 86.02 billion in 2022, growing at a CAGR of 5.74{47b453017e945efa530f5a0970507fdb946b2530ae0a03634d0aa42ba42c4637}. The growing disposable income, rapid shifting towards urbanization, and modernization are also major drivers for the carpet flooring market globally. The introduction of innovative and differentiated products and green technologies further fuel the market’s growth. Moreover, the travel & tourism and construction industries contribute the most to the market globally.

U.S. Wall Repair Products Market – Industry Outlook & Forecast 2022-2027: The U.S. wall repair products market is expected to reach USD 12.28 billion by 2027 from USD 9.33 billion in 2022, growing at a CAGR of 4.69{47b453017e945efa530f5a0970507fdb946b2530ae0a03634d0aa42ba42c4637} during the forecast period. Rapid industrialization and increasing applications in the household and commercial sectors are primarily driving the wall repair products market. These repair products are mainly used in the residential sector since the construction of housing units in the U.S. is drywall. Drywall is rigid, however, not indestructible. Over time, gypsum-board walls can withstand ugly cracks or holes. Fortunately, drywalls can be easily fixable. Therefore, the construction of drywall housing is expected to surge the demand for wall repair products in the U.S.

Table of Content

1 RESEARCH METHODOLOGY

2 RESEARCH OBJECTIVES

3 RESEARCH PROCESS

4 SCOPE & COVERAGE

4.1 MARKET DEFINITION

4.1.1 INCLUSIONS

4.1.2 EXCLUSIONS

4.1.3 MARKET ESTIMATION CAVEATS

4.2 BASE YEAR

4.3 SCOPE OF THE STUDY

4.3.1 MARKET SEGMENTATION BY PRODUCT

4.3.2 MARKET SEGMENTATION BY APPLICATION

4.3.3 MARKET SEGMENTATION BY DISTRIBUTION CHANNEL

4.3.4 MARKET SEGMENTATION BY END USER

4.3.5 MARKET SEGMENTATION BY NON-RESIDENTIAL END USER

4.3.6 MARKET SEGMENTATION BY GEOGRAPHY

5 REPORT ASSUMPTIONS & CAVEATS

5.1 KEY CAVEATS

5.2 CURRENCY CONVERSION

5.3 MARKET DERIVATION

6 PREMIUM INSIGHTS

6.1 MARKET DEFINITION

6.2 REPORT OVERVIEW

6.3 RUSSIA–UKRAINE TRADE ISSUES

6.4 ANALYSIS OF OPPORTUNITIES & CHALLENGES

6.5 SEGMENT ANALYSIS

6.6 REGIONAL ANALYSIS

6.7 COMPETITIVE LANDSCAPE

7 MARKET AT A GLANCE

8 INTRODUCTION

8.1 OVERVIEW

8.1.1 RESIDENTIAL CONSTRUCTION

8.1.2 NON-RESIDENTIAL & INDUSTRIAL CONSTRUCTION

8.1.3 PUBLIC INFRASTRUCTURAL CONSTRUCTIONS

8.2 OVERALL CONSTRUCTION INDUSTRY OUTLOOK

8.3 GLOBAL ECONOMIC SCENARIO

8.4 RUSSIA–UKRAINE TRADE ISSUES

8.5 RECENT DEVELOPMENTS

8.6 RISK FACTORS IN MARKET

8.7 VALUE CHAIN ANALYSIS

8.7.1 MATERIAL SUPPLIERS

8.7.2 MANUFACTURERS

8.7.3 DISTRIBUTORS

8.7.4 APPLICATIONS

9 MARKET OPPORTUNITIES & TRENDS

9.1 SURGE IN DIGITAL MARKETING PARTNERSHIPS

9.2 EMERGING NEW TECHNOLOGIES IN FLOORING MARKET

9.3 HIGH DEMAND FOR LUXURY VINYL TILES

10 MARKET GROWTH ENABLERS

10.1 GROWING INFRASTRUCTURAL DEVELOPMENT IN COMMERCIAL SECTOR

10.2 INCREASE IN NEW CONSTRUCTION AND REMODELING PROJECTS IN RESIDENTIAL

SECTOR

10.3 RISING DEMAND FOR FLOORING PRODUCTS IN SPORTS INDUSTRY

10.4 MASS TOWNSHIP PROJECTS

11 MARKET RESTRAINTS

11.1 RISE IN ENVIRONMENTAL & HEALTH CONCERNS

11.2 SIGNIFICANT DEMAND FOR CONCRETE FLOORING IN LOW- AND MIDDLE-INCOME

COUNTRIES

11.3 LACK OF SKILLED LABOR

12 MARKET LANDSCAPE

12.1 MARKET OVERVIEW

12.2 KEY INSIGHTS

12.3 DEMAND INSIGHTS

12.4 VENDOR ANALYSIS

12.5 CONSUMER BUYING BEHAVIOR

12.6 MARKET SIZE & FORECAST

12.7 PRODUCT

12.7.1 MARKET SIZE & FORECAST

12.8 APPLICATION

12.8.1 MARKET SIZE & FORECAST

12.9 DISTRIBUTION CHANNEL

12.9.1 MARKET SIZE & FORECAST

12.10 END USERS

12.10.1 MARKET SIZE & FORECAST

12.11 NON-RESIDENTIAL

12.11.1 MARKET SIZE & FORECAST

12.12 FIVE FORCES ANALYSIS

12.12.1 THREAT OF NEW ENTRANTS

12.12.2 BARGAINING POWER OF SUPPLIERS

12.12.3 BARGAINING POWER OF BUYERS

12.12.4 THREAT OF SUBSTITUTES

12.12.5 COMPETITIVE RIVALRY

13 PRODUCT

13.1 MARKET SNAPSHOT & GROWTH ENGINE

13.2 MARKET OVERVIEW

13.3 NON-RESILIENT FLOORING

13.3.1 MARKET OVERVIEW

13.3.2 MARKET SIZE & FORECAST

13.3.3 MARKET BY GEOGRAPHY

13.3.4 WOOD & LAMINATE: MARKET SIZE & FORECAST

13.3.5 MARKET BY GEOGRAPHY

13.3.6 CERAMIC TILES: MARKET SIZE & FORECAST

13.3.7 MARKET BY GEOGRAPHY

13.3.8 CARPET: MARKET SIZE & FORECAST

13.3.9 MARKET BY GEOGRAPHY

13.3.10 OTHERS: MARKET SIZE & FORECAST

13.3.11 MARKET BY GEOGRAPHY

13.4 RESILIENT FLOORING

13.4.1 MARKET OVERVIEW

13.4.2 MARKET SIZE & FORECAST

13.4.3 MARKET BY GEOGRAPHY

13.4.4 LVT

13.4.5 LINOLEUM

13.4.6 VINYL SHEETS

14 APPLICATION

14.1 MARKET SNAPSHOT & GROWTH ENGINE

14.2 MARKET OVERVIEW

14.3 REPLACEMENT

14.3.1 MARKET OVERVIEW

14.3.2 MARKET SIZE & FORECAST

14.3.3 MARKET BY GEOGRAPHY

14.4 NEW CONSTRUCTION

14.4.1 MARKET OVERVIEW

14.4.2 MARKET SIZE & FORECAST

14.4.3 MARKET BY GEOGRAPHY

15 DISTRIBUTION CHANNEL

15.1 MARKET SNAPSHOT & GROWTH ENGINE

15.2 MARKET OVERVIEW

15.3 OFFLINE

15.3.1 MARKET OVERVIEW

15.3.2 MARKET SIZE & FORECAST

15.3.3 MARKET BY GEOGRAPHY

15.4 ONLINE

15.4.1 MARKET OVERVIEW

15.4.2 MARKET SIZE & FORECAST

15.4.3 MARKET BY GEOGRAPHY

16 END USER

16.1 MARKET SNAPSHOT & GROWTH ENGINE

16.2 MARKET OVERVIEW

16.3 RESIDENTIAL

16.3.1 MARKET OVERVIEW

16.3.2 MARKET SIZE & FORECAST

16.3.3 MARKET BY GEOGRAPHY

16.4 NON-RESIDENTIAL

16.4.1 MARKET OVERVIEW

16.4.2 MARKET SIZE & FORECAST

16.4.3 MARKET BY GEOGRAPHY

16.4.4 MEDICAL & CARE CENTERS: MARKET SIZE & FORECAST

16.4.5 MARKET BY GEOGRAPHY

16.4.6 RETAIL STORES: MARKET SIZE & FORECAST

16.4.7 MARKET BY GEOGRAPHY

16.4.8 EDUCATIONAL FACILITIES: MARKET SIZE & FORECAST

16.4.9 MARKET BY GEOGRAPHY

16.4.10 HOSPITALITY & LODGING: MARKET SIZE & FORECAST

16.4.11 MARKET BY GEOGRAPHY

16.4.12 OFFICES: MARKET SIZE & FORECAST

16.4.13 MARKET BY GEOGRAPHY

16.4.14 SPORTS & ENTERTAINMENT: MARKET SIZE & FORECAST

16.4.15 MARKET BY GEOGRAPHY

16.4.16 OTHERS: MARKET SIZE & FORECAST

16.4.17 MARKET BY GEOGRAPHY

17 GEOGRAPHY

17.1 MARKET SNAPSHOT & GROWTH ENGINE

17.2 GEOGRAPHIC OVERVIEW

18 APAC

18.1 MARKET OVERVIEW

18.2 MARKET SIZE & FORECAST

18.3 PRODUCT

18.3.1 MARKET SIZE & FORECAST

18.4 NON-RESILIENT FLOORING

18.4.1 MARKET SIZE & FORECAST

18.5 APPLICATION

18.5.1 MARKET SIZE & FORECAST

18.6 DISTRIBUTION CHANNEL

18.6.1 MARKET SIZE & FORECAST

18.7 END USER

18.7.1 MARKET SIZE & FORECAST

18.8 NON-RESIDENTIAL

18.8.1 MARKET SIZE & FORECAST

18.9 KEY COUNTRIES

18.9.1 CHINA: MARKET SIZE & FORECAST

18.9.2 INDIA: MARKET SIZE & FORECAST

18.9.3 JAPAN: MARKET SIZE & FORECAST

18.9.4 AUSTRALIA: MARKET SIZE & FORECAST

18.9.5 SOUTH KOREA: MARKET SIZE & FORECAST

19 NORTH AMERICA

19.1 MARKET OVERVIEW

19.2 MARKET SIZE & FORECAST

19.3 PRODUCT

19.3.1 MARKET SIZE & FORECAST

19.4 NON-RESILIENT FLOORING

19.4.1 MARKET SIZE & FORECAST

19.5 APPLICATION

19.5.1 MARKET SIZE & FORECAST

19.6 DISTRIBUTION CHANNEL

19.6.1 MARKET SIZE & FORECAST

19.7 END USER

19.7.1 MARKET SIZE & FORECAST

19.8 NON-RESIDENTIAL

19.8.1 MARKET SIZE & FORECAST

19.9 KEY COUNTRIES

19.9.1 US: MARKET SIZE & FORECAST

19.9.2 CANADA: MARKET SIZE & FORECAST

20 EUROPE

20.1 MARKET OVERVIEW

20.2 MARKET SIZE & FORECAST

20.3 PRODUCT

20.3.1 MARKET SIZE & FORECAST

20.4 NON-RESILIENT FLOORING

20.4.1 MARKET SIZE & FORECAST

20.5 APPLICATION

20.5.1 MARKET SIZE & FORECAST

20.6 DISTRIBUTION CHANNEL

20.6.1 MARKET SIZE & FORECAST

20.7 END USER

20.7.1 MARKET SIZE & FORECAST

20.8 NON-RESIDENTIAL

20.8.1 MARKET SIZE & FORECAST

20.9 KEY COUNTRIES

20.9.1 GERMANY: MARKET SIZE & FORECAST

20.9.2 UK: MARKET SIZE & FORECAST

20.9.3 FRANCE: MARKET SIZE & FORECAST

20.9.4 ITALY: MARKET SIZE & FORECAST

20.9.5 SPAIN: MARKET SIZE & FORECAST

21 MIDDLE EAST & AFRICA

21.1 MARKET OVERVIEW

21.2 MARKET SIZE & FORECAST

21.3 PRODUCT

21.3.1 MARKET SIZE & FORECAST

21.4 NON-RESILIENT FLOORING

21.4.1 MARKET SIZE & FORECAST

21.5 APPLICATION

21.5.1 MARKET SIZE & FORECAST

21.6 DISTRIBUTION CHANNEL

21.6.1 MARKET SIZE & FORECAST

21.7 END USER

21.7.1 MARKET SIZE & FORECAST

21.8 NON-RESIDENTIAL

21.8.1 MARKET SIZE & FORECAST

21.9 KEY COUNTRIES

21.9.1 SAUDI ARABIA: MARKET SIZE & FORECAST

21.9.2 UAE: MARKET SIZE & FORECAST

21.9.3 TURKEY: MARKET SIZE & FORECAST

21.9.4 SOUTH AFRICA: MARKET SIZE & FORECAST

22 LATIN AMERICA

22.1 MARKET OVERVIEW

22.2 MARKET SIZE & FORECAST

22.3 PRODUCT

22.3.1 MARKET SIZE & FORECAST

22.4 NON-RESILIENT FLOORING

22.4.1 MARKET SIZE & FORECAST

22.5 APPLICATION

22.5.1 MARKET SIZE & FORECAST

22.6 DISTRIBUTION CHANNEL

22.6.1 MARKET SIZE & FORECAST

22.7 END USER

22.7.1 MARKET SIZE & FORECAST

22.8 NON-RESIDENTIAL

22.8.1 MARKET SIZE & FORECAST

22.9 KEY COUNTRIES

22.9.1 BRAZIL: MARKET SIZE & FORECAST

22.9.2 MEXICO: MARKET SIZE & FORECAST

22.9.3 ARGENTINA: MARKET SIZE & FORECAST

23 COMPETITIVE LANDSCAPE

23.1 COMPETITION OVERVIEW

23.2 MARKET STRUCTURE & MAPPING OF COMPETITION

23.2.1 HERFINDAHL-HIRSCHMAN INDEX

24 KEY COMPANY PROFILES

24.1 MOHAWK INDUSTRIES

24.1.1 BUSINESS OVERVIEW

24.1.2 FINANCIAL HIGHLIGHTS

24.1.3 AMERICAN OLEAN: PRODUCT OFFERINGS

24.1.4 DALTILE: PRODUCT OFFERINGS

24.1.5 ELIANE: PRODUCT OFFERINGS

24.1.6 FELTEX: PRODUCT OFFERINGS

24.1.7 GODFREY HIRST: PRODUCT OFFERINGS

24.1.8 IVC COMMERCIAL: PRODUCT OFFERINGS

24.1.9 IVC HOME: PRODUCT OFFERINGS

24.1.10 KARASTAN: PRODUCT OFFERINGS

24.1.11 KERAMA MARAZZI: PRODUCT OFFERINGS

24.1.12 MARAZZI GROUP: PRODUCT OFFERINGS

24.1.13 MODULEO: PRODUCT OFFERINGS

24.1.14 MOHAWK INDUSTRIES: PRODUCT OFFERINGS

24.1.15 PERGO: PRODUCT OFFERINGS

24.1.16 QUICK-STEP: PRODUCT OFFERINGS

24.1.17 UNILIN: PRODUCT OFFERINGS

24.1.18 KEY STRATEGIES

24.1.19 KEY STRENGTHS

24.1.20 KEY OPPORTUNITIES

24.2 FORBO FLOORING

24.2.1 BUSINESS OVERVIEW

24.2.2 FINANCIAL HIGHLIGHTS

24.2.3 FORBO FLOORING: PRODUCT OFFERINGS

24.2.4 KEY STRATEGIES

24.2.5 KEY STRENGTHS

24.2.6 KEY OPPORTUNITIES

24.3 BEAULIEU INTERNATIONAL GROUP

24.3.1 BUSINESS OVERVIEW

24.3.2 FINANCIAL HIGHLIGHTS

24.3.3 BEAULIEU INTERNATIONAL GROUP (B.I.G.): PRODUCT OFFERINGS

24.3.4 KEY STRATEGIES

24.3.5 KEY STRENGTHS

24.3.6 KEY OPPORTUNITIES

24.4 GRUPO LAMOSA

24.4.1 BUSINESS OVERVIEW

24.4.2 FINANCIAL HIGHLIGHTS

24.4.3 LAMOSA PISOS & MUROS: PRODUCT OFFERINGS

24.4.4 PORCELANITE: PRODUCT OFFERINGS

24.4.5 CORDILLERA: PRODUCT OFFERINGS

24.4.6 CERAMICA SAN LORENZO: PRODUCT OFFERINGS

24.4.7 ROCA: PRODUCT OFFERINGS

24.4.8 KEY STRATEGIES

24.4.9 KEY STRENGTHS

24.4.10 KEY OPPORTUNITIES

24.5 LL FLOORING HOLDINGS

24.5.1 BUSINESS OVERVIEW

24.5.2 FINANCIAL HIGHLIGHTS

24.5.3 LL FLOORING HOLDINGS: PRODUCT OFFERINGS

24.5.4 KEY STRATEGIES

24.5.5 KEY STRENGTHS

24.5.6 KEY OPPORTUNITIES

24.6 RAK CERAMICS

24.6.1 BUSINESS OVERVIEW

24.6.2 FINANCIAL HIGHLIGHTS

24.6.3 RAK CERAMICS: PRODUCT OFFERINGS

24.6.4 KEY STRATEGIES

24.6.5 KEY STRENGTHS

24.6.6 KEY OPPORTUNITIES

24.7 TARKETT

24.7.1 BUSINESS OVERVIEW

24.7.2 FINANCIAL HIGHLIGHTS

24.7.3 TARKETT: PRODUCT OFFERINGS

24.7.4 KEY STRATEGIES

24.7.5 KEY STRENGTHS

24.7.6 KEY OPPORTUNITIES

24.8 SHAW INDUSTRIES GROUP (BERKSHIRE HATHAWAY)

24.8.1 BUSINESS OVERVIEW

24.8.2 FINANCIAL HIGHLIGHTS

24.8.3 ANDERSON TUFTEX: PRODUCT OFFERINGS

24.8.4 CORETEC: PRODUCT OFFERINGS

24.8.5 FLOORIGAMI: PRODUCT OFFERINGS

24.8.6 SHAW FLOORS: PRODUCT OFFERINGS

24.8.7 SHAW SPORTS TURF: PRODUCT OFFERINGS

24.8.8 SOUTHWEST GREENS: PRODUCT OFFERINGS

24.8.9 PHILADELPHIA COMMERCIAL: PRODUCT OFFERINGS

24.8.10 SHAWCONTRACT: PRODUCT OFFERINGS

24.8.11 KEY STRATEGIES

24.8.12 KEY STRENGTHS

24.8.13 KEY OPPORTUNITIES

24.9 INTERFACE

24.9.1 BUSINESS OVERVIEW

24.9.2 FINANCIAL HIGHLIGHTS

24.9.3 INTERFACE: PRODUCT OFFERINGS

24.9.4 KEY STRATEGIES

24.9.5 KEY STRENGTHS

24.9.6 KEY OPPORTUNITIES

24.10 VICTORIA

24.10.1 BUSINESS OVERVIEW

24.10.2 FINANCIAL HIGHLIGHTS

24.10.3 CARPET LINE DIRECT: PRODUCT OFFERINGS

24.10.4 VICTORIA CARPETS: PRODUCT OFFERINGS

24.10.5 DOM DESIGN LAB: PRODUCT OFFERINGS

24.10.6 HEARTRIDGE: PRODUCT OFFERINGS

24.10.7 KEY STRATEGIES

24.10.8 KEY STRENGTHS

24.10.9 KEY OPPORTUNITIES

25 OTHER PROMINENT VENDORS

25.1 BURKE FLOORING (MANNINGTON COMMERCIAL, MANNINGTON MILLS)

25.1.1 BUSINESS OVERVIEW

25.1.2 BURKE FLOORING (MANNINGTON COMMERCIAL, MANNINGTON MILLS): PRODUCT

OFFERINGS

25.2 GERFLOR GROUP

25.2.1 BUSINESS OVERVIEW

25.2.2 GERFLOR GROUP: PRODUCT OFFERINGS

25.3 PAMESA CERAMICA COMPACTTO

25.3.1 BUSINESS OVERVIEW

25.3.2 PAMESA CERAMICA COMPACTTO: PRODUCT OFFERINGS

25.4 AHF

25.4.1 BUSINESS OVERVIEW

25.4.2 AHF: PRODUCT OFFERINGS

25.5 KAJARIA CERAMICS

25.5.1 BUSINESS OVERVIEW

25.5.2 KAJARIA CERAMICS: PRODUCT OFFERINGS

25.6 PORTOBELLO

25.6.1 BUSINESS OVERVIEW

25.6.2 PORTOBELLO: PRODUCT OFFERINGS

25.7 POLYFLOR

25.7.1 BUSINESS OVERVIEW

25.7.2 POLYFLOR: PRODUCT OFFERINGS

25.8 CROSSVILLE

25.8.1 BUSINESS OVERVIEW

25.8.2 CROSSVILLE: PRODUCT OFFERINGS

25.9 PORCELANOSA GRUPO

25.9.1 BUSINESS OVERVIEW

25.9.2 PORCELANOSA GRUPO: PRODUCT OFFERINGS

25.10 SCG CERAMICS

25.10.1 BUSINESS OVERVIEW

25.10.2 SCG CERAMICS: PRODUCT OFFERINGS

25.11 CONGOLEUM

25.11.1 BUSINESS OVERVIEW

25.11.2 CONGOLEUM: PRODUCT OFFERINGS

25.12 THE DIXIE GROUP

25.12.1 BUSINESS OVERVIEW

25.12.2 THE DIXIE HOME: PRODUCT OFFERINGS

25.12.3 FABRICA: PRODUCT OFFERINGS

25.12.4 MASLAND CARPETS: PRODUCT OFFERINGS

25.12.5 TRUCOR: PRODUCT OFFERINGS

25.13 BRUMARK (EXPLORING)

25.13.1 BUSINESS OVERVIEW

25.13.2 BRUMARK: PRODUCT OFFERINGS

25.14 DORSETT INDUSTRIES

25.14.1 BUSINESS OVERVIEW

25.14.2 DORSETT INDUSTRIES: PRODUCT OFFERINGS

25.15 MILLIKEN

25.15.1 BUSINESS OVERVIEW

25.15.2 MILLIKEN: PRODUCT OFFERINGS

25.16 ORIENTAL WEAVERS

25.16.1 BUSINESS OVERVIEW

25.16.2 ORIENTAL WEAVERS: PRODUCT OFFERINGS

25.17 AXMINSTER CARPETS

25.17.1 BUSINESS OVERVIEW

25.17.2 AXMINSTER CARPETS: PRODUCT OFFERINGS

25.18 BRINTONS CARPETS

25.18.1 BUSINESS OVERVIEW

25.18.2 BRINTONS CARPETS: PRODUCT OFFERINGS

25.19 BETAP

25.19.1 BUSINESS OVERVIEW

25.19.2 BETAP: PRODUCT OFFERINGS

26 REPORT SUMMARY

26.1 KEY TAKEAWAYS

26.2 STRATEGIC RECOMMENDATIONS

27 QUANTITATIVE SUMMARY

27.1 PRODUCT

27.1.1 MARKET SIZE & FORECAST

27.2 NON-RESILIENT FLOORING

27.2.1 MARKET SIZE & FORECAST

27.3 APPLICATION

27.3.1 MARKET SIZE & FORECAST

27.4 DISTRIBUTION CHANNEL

27.4.1 MARKET SIZE & FORECAST

27.5 END USER

27.5.1 MARKET SIZE & FORECAST

27.6 NON-RESIDENTIAL

27.6.1 MARKET SIZE & FORECAST

27.7 MARKET BY GEOGRAPHY

27.8 APAC

27.8.1 PRODUCT: MARKET SIZE & FORECAST

27.8.2 NON-RESILIENT FLOORING: MARKET SIZE & FORECAST

27.8.3 APPLICATION: MARKET SIZE & FORECAST

27.8.4 DISTRIBUTION CHANNEL: MARKET SIZE & FORECAST

27.8.5 END USER: MARKET SIZE & FORECAST

27.8.6 NON-RESIDENTIAL: MARKET SIZE & FORECAST

27.9 NORTH AMERICA

27.9.1 PRODUCT: MARKET SIZE & FORECAST

27.9.2 NON-RESILIENT FLOORING: MARKET SIZE & FORECAST

27.9.3 APPLICATION: MARKET SIZE & FORECAST

27.9.4 DISTRIBUTION CHANNEL: MARKET SIZE & FORECAST

27.9.5 END-USER: MARKET SIZE & FORECAST

27.9.6 NON-RESIDENTIAL: MARKET SIZE & FORECAST

27.10 EUROPE

27.10.1 PRODUCT: MARKET SIZE & FORECAST

27.10.2 NON-RESILIENT FLOORING: MARKET SIZE & FORECAST

27.10.3 APPLICATION: MARKET SIZE & FORECAST

27.10.4 DISTRIBUTION CHANNEL: MARKET SIZE & FORECAST

27.10.5 END-USER: MARKET SIZE & FORECAST

27.10.6 NON-RESIDENTIAL: MARKET SIZE & FORECAST

27.11 MIDDLE EAST & AFRICA

27.11.1 PRODUCT: MARKET SIZE & FORECAST

27.11.2 NON-RESILIENT FLOORING: MARKET SIZE & FORECAST

27.11.3 APPLICATION: MARKET SIZE & FORECAST

27.11.4 DISTRIBUTION CHANNEL: MARKET SIZE & FORECAST

27.11.5 END USER: MARKET SIZE & FORECAST

27.11.6 NON-RESIDENTIAL: MARKET SIZE & FORECAST

27.12 LATIN AMERICA

27.12.1 PRODUCT: MARKET SIZE & FORECAST

27.12.2 NON-RESILIENT FLOORING: MARKET SIZE & FORECAST

27.12.3 APPLICATION: MARKET SIZE & FORECAST

27.12.4 DISTRIBUTION CHANNEL: MARKET SIZE & FORECAST

27.12.5 END USER: MARKET SIZE & FORECAST

27.12.6 NON-RESIDENTIAL: MARKET SIZE & FORECAST

28 APPENDIX

28.1 ABBREVIATIONS

About Us:

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.

Click Here to Contact Us

Call: +1-312-235-2040

+1 302 469 0707

Mail: [email protected]

Photo: https://mma.prnewswire.com/media/1997501/Flooring_Market.jpg

Logo: https://mma.prnewswire.com/media/818553/Arizton_Logo.jpg

View original content to download multimedia:https://www.prnewswire.com/news-releases/flooring-market-to-cross-usd-500-billion-by-2028-growing-at-a-cagr-of-6-during-2022-2028-mohawk-industries-inc-forbo-flooring-beaulieu-international-group-big-and-grupo-lamosa-are-among-the-major-stakeholders—arizto-301740621.html

SOURCE Arizton Advisory & Intelligence